IMMEDIATE DOWNLOAD

FOR FINANCIAL PROFESSIONALS ONLY - NOT INTENDED FOR CONSUMERS

The new Lifetime Income Choice guaranteed living benefit offers the Max Income Option with initial income of up to 7.25% (Age 72+, single life). The high initial withdrawal rates for Max Income allow clients to use less money than a traditional "5 for life" strategy to generate

the income they need for retirement.

That means clients get MORE from less!

Download & Share This Idea Today

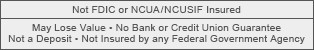

Index annuities are not a direct investment in the stock market. They are long-term insurance products with guarantees backed by the claims-paying ability of the issuing insurance company. They provide the potential for interest to be credited based in part on the performance of the specified index, without the risk of loss of premium due to market downturns or fluctuations. Index annuities may not be appropriate for all individuals. Withdrawals may be subject to federal and/or state income taxes.An additional 10% federal tax may apply if you make withdrawals or surrender your annuity before age 59½. Please consult a tax advisor regarding your specific situation.All contract and benefit guarantees, including any fixed account crediting rates or annuity rates, are backed by the claims-paying ability of the issuing insurance company. They are not backed by the broker/dealer from which this annuity is purchased, by the insurance agency from which this annuity is purchased or any affiliates of those entities and none makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.Lifetime Income Choice is a guaranteed living benefit rider available at contract issue in select Power Series Index Annuities for an annual fee of 1.10% of the Income Base. The Income Base is initially equal to the first eligible premium. The Income Base is adjusted for withdrawals (prior to activating the lifetime income benefit) and excess withdrawals (after activation and the first lifetime withdrawal). Eligible premiums are all premiums made in the first 30 days of the contract. On each contract anniversary, the Income Base is set to equal the greater of 1) the contract value; or 2) the Income Base increased by any available income credit.The Max Income Option is one of two lifetime income options available under Lifetime Income Choice. The Max Income option allows clients to take out the Maximum Annual Withdrawal Percentage (MAWP) while the contract value remains positive. The Protected Income Payment Percentage (PIPP) continues for life after the contract value is depleted. The MAWP ranges from 3.25% to 7.25%, depending on the age at the time of lifetime income activation and the number of individuals covered (single or joint life). The PIPP ranges from 2.60% to 4.00% and is also based on age of lifetime income activation and single or joint life coverage. The name Max Income does not imply that it will proved more income than the Level Income Option over the life of the contract. The Level Income Option provides consistent withdrawal rates before and after the contract value is depleted. One option must be elected at issue and cannot be changed thereafter.Index annuities are issued by American General Life Insurance Company (AGL), 2727-A Allen Parkway, Houston, Texas. AGL is a member company of American International Group, Inc. (AIG). The underwriting risks, financial and contractual obligations and support functions associated with the annuities issued by AGL are its responsibility. Guarantees are backed by the claims-paying ability of AGL. AGL does not solicit business in the state of New York. Annuities and riders may vary by state and are not available in all states.© 2021 American International Group, Inc. All rights reserved .

I6241EM3 (3/21)